The debate over public employee pay and benefits has played out more like an episode of the X Files tan a documentary, particularly over the past several months. A new UC Berkley study reveals the truth about public employee pay and benefits.  No more mystery, no more hyperbole, because “The truth is out there;†finally. From the study:

The debate over public employee pay and benefits has played out more like an episode of the X Files tan a documentary, particularly over the past several months. A new UC Berkley study reveals the truth about public employee pay and benefits.  No more mystery, no more hyperbole, because “The truth is out there;†finally. From the study:

Recently, there has been a great deal of debate and consternation over the compensation of public-sector employees across the U.S. It has been asserted that state and local government employees are overpaid compared to workers in the private sector. In California government workers have been vilified as scandals and anecdotes pass as confirming evidence of exorbitant pay. This research is especially important given the outrage over the pay of municipal officials in Bell, California. The outrage over what happened in Bell is reasonable and just. Many of the players immediately resigned and on September 21, 2010 eight city officials were arrested.1 Those arrested include the former city manager of Bell, Robert Rizzo, who was making nearly $800,000 a year. Rizzo was charged with 53 counts. It is alleged that Rizzo, without approval from the City Council, actually wrote the conditions of his own contract—the case keeps growing in terms of scope and involved officials. It is clear by the arrests and scores of allegations that the situation in Bell was not in line with usual procedures.

While anecdotes that stem from public-sector corruption capture much attention, it is a data-driven analysis of public-sector pay and compensation that is needed to answer the question: How do the pay and benefits of public sector workers compare to those in the private sector? This is a legitimate question that should not be answered anecdotally. The research in this paper investigates empirically whether California public employees are overpaid at the expense of California taxpayers.

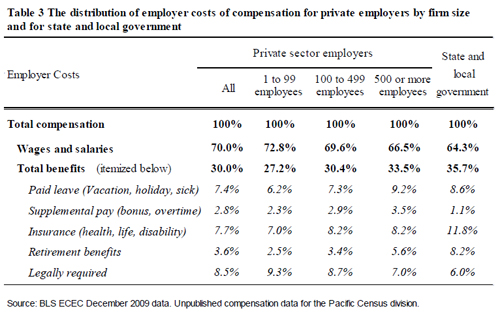

The results from this analysis indicate that California public employees, both state and local, are not overpaid. The wages received by California public employees are about 7% lower, on average, than wages received by comparable private sector workers; however, public employees do receive more generous benefits. An apples-to-apples comparison, or one that controls for education, experience, and other factors that may influence pay, reveals no significant difference in the level of employee compensation costs on an annual or per hour basis between private and public sector workers.

The report concludes:

The Great Recession continues to leave a great deal of economic pain and scarring in its wake. But, the vilification of government workers is sorely misplaced and has left the real culprits of this devastating downturn off the hook. Compensation received by public sector employees is neither the cause—nor can it be the solution—to the state’s financial problems. Only an economic recovery can begin to plug the hole in the state’s budget…

Public sector workers help our communities to thrive and provide services that make it worthwhile to live in them—it is wrong to blame them for the fallout from the greatest economic downturn since the Great Depression.

Read the report for yourself here.

They forgot to factor in the present cost of the future unfunded pensions and health benefits .

Pensions for state employees comes from CALPERS. Yes, the state does contribute towards those pensions, just like a private company does for their employees. But, like in the private sector, state employees also contribute towards their pensions. The fund is like an enormous annuity. I have several friends that died before they were able to withdraw any money for retirement. Their contributions are still in the fund.

I work in IT. The only time our union did anything for IT personnel was when we tried to seperate from it and have our own union. The union pulled every dirty trick in the book to squash that, claiming that the benefits they had won for us would be lost if we went through with the action (this was pattently false). Anyway, those benefits were lost a year later anyway when we were forced to take furloughs. Now, with a new contract we have lost 8% of our pay and will only receive a 3% increase in 2013. Considering inflation at 4% per annum, we will be another 11% behind by then. When I retire in 6 years, I just might be back up to what I was making 2 years ago, but my purchasing power will be significantly decreased.

Could be because present costs of future benefits doesn’t apply.

Do you book the future cost of your home mortgage?

Of course I do, The people who don’t factor in the future costs of their mortgage are in foreclosure today.

I’m a Berkeley grad. I think they missed the mark on this one. A better study on teacher’s compensation can be found at the Manhattan Institute. It was completed in 2007 and adjusts for hours worked, etc. (because teachers work only 9-10 months out of the year). They looked at data for the entire country from the Bureau of Labor Statistics.