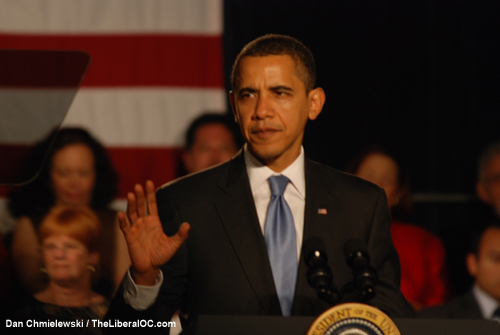

Today, President Barack Obama is scheduled to propose a new tax on the wealthiest of American’s, people making over $1 million annually. GOP Representative Paul Ryan called the President’s proposal class warfare. On Fox News Sunday Ryan said:

“It adds further instability to our system, more uncertainty, and it punishes job creation, Class warfare may make for really good politics, but it makes for rotten economics.”

The problem with Ryan’s position, and that of the rest of the GOP leadership, is that this proposal simply levels the tax playing field for all Americans. Most of the multimillionaires in the US are not earning those millions on payroll. They are earning these sums on stocks and interest, on which they pay a maximum 15% income tax rate. A family with an annual household income of $125,000 a year pays a maximum tax rate of 36% in federal income taxes.

The Buffett Rule, that the President will propose, will be a modest bump in the income tax rate for wealthy Americans that will help balance the burden of supporting our nation and restoring our economy. Here is the overview of the President’s Plan for Economic Growth and Deficit Reduction.

UPDATE: The President is not however proposing increases in tax rates. Rather, he is proposing the elimination of tax breaks and loopholes.

- Allowing the 2001 and 2003 tax cuts for upper income earners to expire ($866 billion)

- Limiting deductions and exclusions for those making more than $250,000 a year ($410 billion)

- Closing loopholes and eliminating special interest tax breaks (approximately $300 billion)

The President addressed the “class warfare” claims of Republicans during his remarks this morning.

This is not class warfare, it’s math.

Now the Republicans are going to complain that a tax on the “job creator’s” is going to hurt the economy. So far we haven’t seen many jobs created by these freeloaders. All we see is them raking in big bucks, and stashing that money away. Tax cuts on the wealthy do not stimulate the economy. Jobs for people who need work stimulate the economy. There is plenty of work available to be done, the wealthy, and the Republican’s in Congress don’t want to spend the money. They just want more tax breaks.

While the idea of taxing the wealthy so that they pay some more of their fair share of the costs of our freedoms is a bit hard for the GOP to understand; it’s the thing to do from an economics point of view. Class warfare occurs when the wealthy place all the burden on the poor. That economic strategy sometimes lead to popular uprisings. Just saying…

The Seven Necessary Steps for Global Economic Recovery

http://www.larouchepac.com/node/19282